Sign up below to be the first to know when we post new content.

WHEB provides their views on sustainable investing in the current economic environment and more...

The Big Exchange announce the introduction of several new funds from Castlefield.

The Big Exchange announce the introduction of the BlueBay Impact-Aligned Bond Fund.

The Big Exchange team discuss whether bonds are a good way to diversify a portfolio...

It’s that time of year when we look back over 2023 to celebrate successes and plan for 2024 and the year ahead.

Liz Rees, Impact Analyst at The Big Exchange, was there to find out more about some of the policies and technologies supporting a sustainable future, and how they are captured in the WHEB Sustainability Fund.

Victoria MacLean, Associate Fund Manager WHEB discusses the changes needed to our energy infrastructure to increase the availability of renewable energy.

Kim Goodall, Impact Analyst at The Big Exchange explains why a “just transition” is important, and how The Big Exchange supports customers who care about both people and planet.

The Big Exchange is delighted to be featured in the Good Investment Review, take a look here…

Seb Beloe, Head of Research at WHEB, looks at what needs to be done to win the war on plastics and which companies are leading the way.

Jonathan Parsons from Artemis Impact Equities Team provides an optimistic outlook for the future of wind power in the UK, even when the wind doesn’t blow!

Hilde Jenssen, Head of Fundamental Equities at Nordea Asset Management (NAM), discusses the global decarbonisation drive and how activities at portfolio level can make a difference.

Artificial Intelligence, also known as AI, has the capability of learning from vast amounts of data, adapting to new information, and making intelligent decisions. Generative AI has the potential to influence how future generations are educated, and investors focusing on sustainability may be able to identify many opportunities to utilise AI for the betterment of people and the planet.

The Big Exchange debates the question whether companies that aim to ‘do good’, do in fact make for a good investment.

The Big Exchange discuses the inherent volatility and the challenges investors face when it comes to the everchanging landscape of the stock market.

The team at Stewart Investors explain why they are optimistic about India as an attractive investment opportunity.

Janus Henderson’s Head of Global Sustainable Equities gives his views on what to look forward to in 2023, with an emphasis on reshoring, rebuilding, and electrification.

The Big Exchange are pleased to announce two new gold medal funds from T. Rowe Price are now available. Founded in 1937, this asset manager, is well known for its growth style of fund management.

We are delighted to introduce CCLA, the UK’s largest charity fund manager to The Big Exchange. Driven by the investment thesis of “Act, Access, and Align”, CCLA is well-known for its proactivity in the ESG investment space through its meaningful and global impact.

%20(2).jpg)

Liz gives an update on the impact of the Janus Henderson funds following their reassessment by The Big Exchange.

We are delighted to announce a new fund is now available on The Big Exchange, our first fund from EdenTree.

We are delighted to welcome this long-established fund to The Big Exchange

Liz talks about why investors should consider ethical property as a way to further diversify their portfolio.

The Heptagon Future Trends Fund focuses on the most important sustainability trends that are likely to have a major impact on our future. We are pleased to offer this fund on the Big Exchange, and it has been awarded a silver medal rating.

Liz takes you through part one of our series on diversification and the options you have available on The Big Exchange when investing.

A Big welcome to Tara and Tom who join our Investment Committee. Read more to find out more about them and what they are bringing to the table.

Read why The Big Exchange has been voted the Best for Sustainable Investors by Boring Money 3 years in a row!

Biodiversity is the number 1 issue raised by investors on The Big Exchange. This blog aims to tell you what you need to know about investing to solve issues facing the environment and Biodiversity.

Read our introduction to a new fund manager on The Big Exchange and learn about their Global Equity Impact Solutions fund.

Read a summary of The Big Exchange's response to the FCA's proposed regulation which aims to build transparency and trust by introducing a set of labels for different types of investment products.

Chris Ralph, Chair of The Big Exchange Investment Committee gives you a rundown of what happened in 2022 and what to look out for in 2023.

Our CEO, Abi, reflects on 2022, her ambitions for The Big Exchange, and what's in store for the year to come.

Good with Money give us the low-down on introducing money talks to our kids and how we can all set them off on the path to understanding personal finances.

See Beloe, Partner and Head of Research at WHEB provides an “A-HA” moment in thinking about battery powered vehicles. And... We bet you didn’t know this bit of unique Norwegian trivia!

Our analysts give you some insight into how they see investments behave in times of increased inflation and help set your expectations for the months ahead.

Neil Goddin, part of the Artemis Positive Future team gives us an insight into a company they believe provides an old solution to a new problem: waste!

The Good Shopping Guide have reviewed The Big Exchange and awarded us their Ethical Accreditation. See more on what's behind the brand and how we live our purpose and try do the ethical thing.

Recent climate related event reminded us of an article hosted by our friends at Pictet in April. Joeri Rogelj noted that the governments and businesses that don’t step up to the challenge of addressing climate change will find it harder to attract investment.

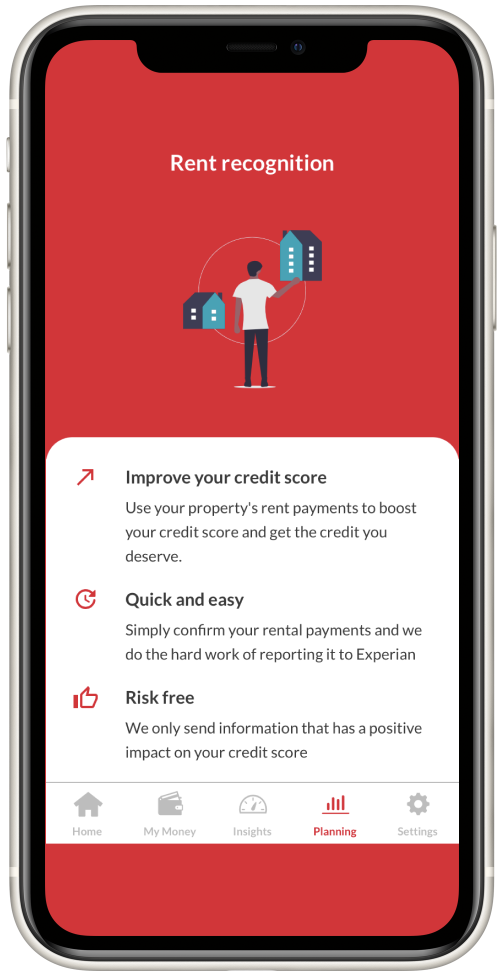

Until now your rent payments haven't been contributing to your credit score. Now, we are offering everyone a newer, simpler and fairer way of building up their credit score.

See how our app's new regular payments feature can help you save money by letting you see all your regular payments in one place.

We take another look into volatility and tell you more about what it means, how it is measured, and what steps you can take to understand it before, during, and after investing.

Volatile markets bring stress - that's a given. But how do we deal with the fluctuating values and constant noise? Hear from Jill about how her experience has helped her navigate choppy waters.

Janus Henderson tell us why they believe that the Biodiversity crisis is just as much a concern as the Climate crisis.

.png)

We have put together 7 tips that we think are useful for both experienced and novice investors. Kudos if you already know all 7!

.jpg)

Why do The Big Exchange plant trees and who do we partner with to make sure it happens the right way? Find out what we do with our partners.

We've added active payments to our money management app and we want to let you know what this means.

As markets continue to be volatile in 2022, Schroders provided us with some educational content to help you see why investing is for the long term.

Find out from Ethical Consumer themselves why The Big Exchange ISA was awarded their Ethical Best Buy.

All abrdn funds have now been re-assessed through our impact methodology for 2022. Read our summary on how they performed.

Our impact analyst Liz gives you some insights into the sustainability of tech holdings and points out why transparency is so important for investors: it allows you to make up your own mind. Make your investments match your own values.

Everyone talks about inflation but what does it mean for you and if you're new to investing, what does it mean for your money?

.png)

Both UBAM funds on The Big Exchange have been re-assessed through our impact methodology. Read our summary on how it performed and why they got Gold.

Meet the new CEO of The Big Exchange who already has experience of leading the company as COO.

.png)

WHEB's Sustainability Fund has been re-assessed through our impact methodology. Read our summary on how it performed and why it has Gold!

Nordea's Global Stars Equity Fund has been re-assessed through our impact methodology. Read our summary on how it performed and why it has a Bronze medal!

Charlene Cranny explains why Greenwashing is so prevalent in investing and why the onus is on individuals to find this out, not the industry to uncover it.

.png)

Stewart Investors funds have all been re-assessed through our impact methodology. Read our summary on how they performed.

This climate-focused fund, from global asset manager abrdn, has undergone its annual reassessment and retains a prized gold medal.

Every 3 months, external experts on our Impact Committee review our impact methodology and keep us up to speed with changes in sustainability. Here is an insight into what went on in the most recent meeting.

Nigel Kershaw OBE, Chair of The Big Issue Group and Co-founder and Director of The Big Exchange, tells us about the history of The Big Exchange and how it is rooted in the aims, ambition, and mission of The Big Issue.

As tax year end approaches, the scammers get more brazen. Here are some useful tips to avoid a common HMRC tax scam.

.png)

Four Janus Henderson funds are welcomed to The Big Exchange. Read the background to the fund manager and get a summary of the fund assessments

You can now invest in Triodos managed funds in your ISA on The Big Exchange. Read more about them here.

We have pulled together a list of common questions from our community and provided answers so that you can stay informed.

On International Women's Day, our guest blogger is Bev Shah, founder of Cityhive and Independent Non-Executive Director of The Big Exchange. Bev shares with us her own experience with getting started on her own investment journey

Dr Vian Sharif, Head of Sustainability at FNZ shares her own views as part of a team driving the development of innovative technology solutions to catalyse the shift to a more sustainable world.

From Hugh Grant to campaigning in finance, Richard Curtis who gives his view on the power of investing to create a better future.

Hear from our friend Georgia at Tumelo on how we are paving the way for a future where all investors know what is inside a fund before they invest.

Lord John Bird, Co-Founder of The Big Issue and Member of the House of Lords talks to us about The Wellbeing of Future Generations Bill and how The Big Exchange fits into our future.

The Big Exchange has been awarded Best for Sustainable Investing in 2022 by Boring Money for the second year running.

We’re pleased to let you know that this Quilter Investors fund listed on the Big Exchange has gone through its annual reassessment and it retains a silver medal.

Our analysts put the most recent interest rate rise by The Bank of England into context.

What is going on with markets in 2022? After such a good year in 2021, we look at what has caused some rocky returns in January.

A second look back at even more things we achieved together in 2021.

A look back at investment performance and our own impact throughout 2021.

Improving diversity in financial services can increase creativity and improve results. Sara Trett from our friends Curation Corp provides a look into why.

Understanding all of the different names for investing can be confusing. We distil it down through our medals, but read on to hear more about the different ways of investing.

Businesses providing renewable energy or recyclable packaging may be among the first that come to mind for people seeking to invest responsibly. However, companies across a broad range of industries are helping to bring about positive change. In all aspects of life, consumers are demanding sustainable products with less waste and the winners will be those that can deliver them.

Guest writer, Charlene Cranny (@CharleneCranny) breaks down some of the myths she picked up growing up and tells us more about the burgers at Crystal Palace Football Club.

Ever wondered if there is a sustainable investment dictionary? We've put a list of common sustainability terms together to help you understand.

A quick insight into how The Big Exchange actually rates investments for their positive impact.

Our friend Nick Jardine from Curation Corp guest writes this blog that talks about why the increasingly conscious consumer demands transparency.

What are the reasons behind women not investing as much as men?

Danyal Sattar, CEO of The Big Issue Invest tell us how Tai Chi can help us understand how connected we are to everything else.

Read a bit more about why investing on The Big Exchange is different and what it could mean for you.

Sign up for news, campaigns, and product updates. Make your money count for more.

The Big Exchange (TBF) Limited is a wholly owned subsidiary of The Big Exchange Limited. The Big Exchange (TBF) Limited is an Appointed Representative of Resolution Compliance Limited, which is authorised and regulated by the Financial Conduct Authority (FRN 574048).

Copyright © 2024 The Big Exchange Limited. The Big Exchange® is a registered trade mark of The Big Exchange Limited.