Until now your rent payments haven't been contributing to your credit score. Now, we are offering everyone a newer, simpler and fairer way of building up their credit score.

The latest stats on home ownership in the UK show that nearly 1 in 5 of us rent our property from a private landlord. That's around 13 million people!

On average, a couple renting off a private landlord spend 41% of their income on rent and social tenants spend 30%, but homeowners spend 18%. Paying 41% of your income regularly should show that you are somewhat reliable when it comes to repaying money, no?

That's not the case, though. Landlords and housing associations aren't considered lenders, or creditors. So, your rent payments won't contribute to improving your credit score.

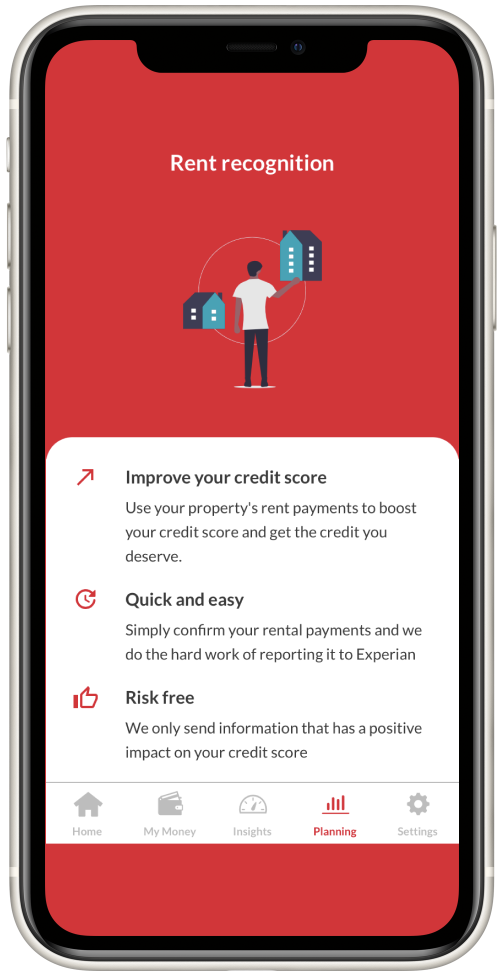

But it's not all doom and gloom. Rental recognition is something which can help change all that and it's on our money management app.

Rental recognition allows you to log your rent payments with Experian and build your credit score in the process.

A credit rating is is a three-digit number that reflects how reliable you are when it comes to repaying money. Your credit score is based on how you've handled money in the past from things such as a bank loan, a mobile phone contract, or your contract with an energy provider. The higher your credit score, the better your chances of being accepted for credit (a mortgage, or loan for example) and at the best rates.

If you can’t build your credit score, it can be a barrier to getting any form of credit. Or if you can get it, it will be at a higher interest rate because people with low credit scores are deemed higher risk.

Rent is a regular payment. It is a commitment, and quite a big one. Making regular, on-time rent payments can be indicative of positive and responsible credit behaviour and makes you look less likely to not be able to repay a loan in the eyes of a bank or mortgage provider.

The Rental recognition feature on our money management app makes it simple to send anonymised details of your rent payments to Experian who are a credit agency. We share the minimum amount of relevant data that will positively contribute to your credit score. That way, we can make sure that your rent is included in building a picture of your financial reliability.

Firstly, you’ll need to download our money management app and link your bank account from which you pay your rent.

Secondly, you select ‘Planning’ from the menu bar and then select Rental recognition. You can then follow the instructions to link your rental payments. Once you have linked your bank accounts, you will be able to select your rent payments to your landlord and we will do the rest.

We will send your rental payments to Experian and other credit agencies through our partners at Moneyhub. In doing so, we are offering alternative credit data which can help people with thin or no credit scores build up the financial reputation they need to access products and services.

If you have any questions or need more support in connecting your rent payments you can contact support and we’ll help you out.

Sign up for news, campaigns, and product updates. Make your money count for more.

The Big Exchange (TBF) Limited is a wholly owned subsidiary of The Big Exchange Limited. The Big Exchange (TBF) Limited is an Appointed Representative of Resolution Compliance Limited, which is authorised and regulated by the Financial Conduct Authority (FRN 574048).

Copyright © 2024 The Big Exchange Limited. The Big Exchange® is a registered trade mark of The Big Exchange Limited.